Self Storage Business Trends: What’s Keeping Operators Up at Night in 2026?

Occupancy, staffing, and rising costs remain the industry’s most significant stress points.

Even in an industry built on consistency, monthly rent checks, recurring tenants, and predictable seasonal swings, 2025 threw self-storage operators a few unexpected curveballs.

Rising costs, slowing demand in some markets, and ongoing staffing headaches made 2025 a year that tested operators’ patience, adaptability, and creativity.

Now, as we move into 2026, many operators are asking the same question: what’s next, and how can we prepare for it?

In this article, we’ll break down the biggest self-storage business trends shaping 2026, from occupancy and staffing pressures to rising operating costs and local competition, and how leaning on the right

self-storage software tools helps operators stay proactive, improve visibility, and run operations smarter without sacrificing service.

Table of Contents

Occupancy, Staffing, and Local Pressures Dominate

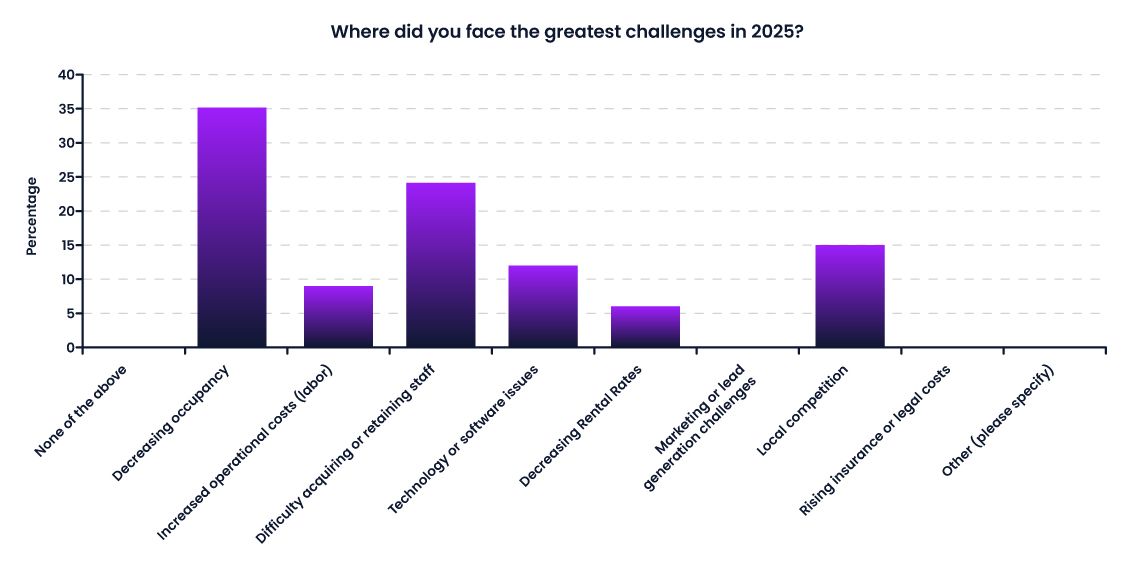

Across nearly every national report, a familiar story emerges. Modern Storage Media reported that higher labor and maintenance costs weighed heavily on operators. Yardi Matrix noted that oversupply in certain Sunbelt metros continued to drag down rates and occupancy. Meanwhile, Storage Commander’s own operator survey put a more human face on those challenges. When asked, “Where did you face the greatest challenges in 2025?” operators answered:

- 35% cited decreasing occupancy as their top concern

- 24% pointed to staffing shortages or retention issues

- 15% mentioned local competition

- 9% said increased operating costs were their most significant problem

What’s interesting isn’t just the ranking, but what it suggests. While costs are undeniably rising, many operators feel the impact most acutely through their people and their properties rather than their profit-and-loss statements. Staffing shortages lead to inconsistent service. Inconsistent service leads to lost tenants. And lost tenants, in turn, deepen occupancy challenges, creating a frustrating cycle that’s tough to break.

Occupancy: A Balancing Act

After a long run of near-record occupancy rates, 2025 brought a dose of normalization. Nationally, occupancy hovered near 90%, according to Cushman & Wakefield, but declines of 3–5% in some metros left operators fighting harder to fill units. Seasonal leasing patterns also returned, forcing facilities that once coasted on high occupancy to dust off their marketing playbooks again. Operators have reported they’re getting more creative, expanding partnerships with local businesses, testing flexible move-in promotions, and investing in digital advertising to reach new customers. But discounts only go so far. The facilities that maintained solid occupancy through 2025 often had one thing in common: they knew their local market and actively managed pricing and promotions week by week. Predictive analytics can have a role in managing this. Investing in technology that can predict attrition will provide a head start for the operator to fill the bay/create a high-quality wait list.

Staffing and Retention: The Human Bottleneck

Finding and keeping qualified staff continues to be a significant stressor. Low unemployment means the same people who might manage your front desk are being wooed by restaurants, hospitality, or even other storage facilities. For small operators without corporate resources or full-time HR teams, turnover can be especially painful. Every new hire requires onboarding, training, and trust building, while day-to-day operations still need to run smoothly. Automation helps, but isn’t a complete solution. Kiosks, online move-ins, and AI-driven communication tools can reduce manual work, but customers still value a friendly face and reliable contact when something goes wrong. It is incumbent on the operator to provide the aura of “white glove” service while keeping staffing to a minimum. Many operators are finding success by cross-training employees, offering performance-based bonuses, and using tools that streamline the working day – reducing repetitive tasks that suck up a lot of time, but yield little value.

Local Competition and Market Fragmentation

Even in stable markets, competition is heating up. Self-storage remains highly localized; what happens across town often matters more than national self-storage business trends. In 2025, new facilities continued to open in growth corridors, adding pressure on existing sites to differentiate. Operators who have thrived under these conditions tend to invest in community presence, sponsoring local events, aligning with real estate agents and moving companies, and maintaining an active social media presence. Visibility builds familiarity, and familiarity drives leads. Storage Commander’s research shows that marketing and technology challenges ranked lower in direct responses (just 12% cited software issues), but that doesn’t mean technology is irrelevant. In fact, it’s the differentiator that helps operators compete at scale vs. large players in the space and especially the REITS.

2026: Confidence Softened, but Opportunity Remains

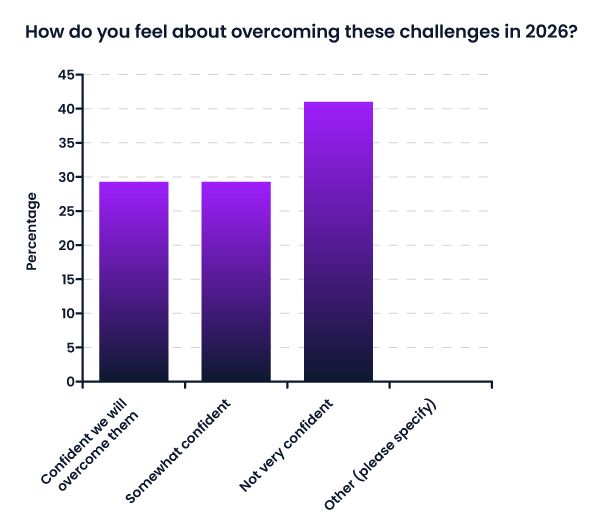

Perhaps the most revealing part of Storage Commander’s research comes from how operators feel about their ability to overcome these challenges. When asked about their outlook for 2026:

- 29% said they are confident they will overcome them

- 29% are somewhat confident

- 41% admitted they are not very confident

That mix of optimism and hesitation mirrors broader industry sentiment. Larger portfolios with access to data analytics, professional management, and flexible rate strategies are weathering the slowdown better. Independent operators, especially those in saturated or slow-growth regions, feel the pinch more deeply. Still, confidence tends to grow with control.

Facilities that invest in tools for data visibility, dynamic pricing, and integrated operations

are better positioned to adapt. When you can see your occupancy trends, lead sources, and conversion data in real time, uncertainty becomes a manageable variable, not a mystery.

What This Means for Operators in 2026

The next competitive frontier isn’t price, it’s performance. As self-storage business trends continue to shift, operators can’t always control market saturation or macroeconomic forces, but they can control execution. The facilities that thrive this year will be those that:

- Prioritize staff retention. Build a culture where employees want to stay. Offer small incentives, flexible scheduling, and recognition for top performers.

- Leverage technology for insight, not just automation. The right tools should make data actionable, helping you adjust rates, forecast occupancy, and simplify collections.

- Stay visible locally. Maintain a consistent presence through reviews, community partnerships, SEO, and localized promotions that reinforce trust and familiarity.

- Plan for adaptability. Track your key performance metrics monthly, not quarterly, and make adjustments quickly when trends shift.

- Stay positive: You started a business because you had a dream. That dream remains real – despite market conditions. One step ahead every day. It’s not a race, it’s a marathon. Keep going.

Bottom Line: Keep an Eye on Agility

The operators who sleep easiest in 2026 won’t necessarily be the ones with the biggest facilities or deepest pockets; they’ll be the ones most capable of adapting. Whether that means experimenting with pricing, cross-training staff, or adopting more innovative management tools, agility is becoming the industry’s new superpower. Tools like

SC Navigator

help bring that agility to life by turning facility data into clear, actionable insight. So, keep an eye on your data, your people, and your local market, because in self-storage, stability doesn’t come from standing still. It comes from moving smart.

Got Questions?

The team at Storage Commander has been at this for decades and has a firm grasp on the unique issues your business faces daily. We are more than a leading provider of self-storage solutions. We are business partners poised to share our insight with you and help you make 2026 your best yet.

Contact us anytime.

Frequently Asked Questions

What are the biggest self-storage business trends operators should watch in 2026?

Occupancy pressure, staffing strain, rising operating costs, and tighter local competition are at the top of the list. The operators who do best will be the ones who stay alert, track performance often, and adjust quickly instead of waiting for problems to show up in the numbers.

How can operators protect occupancy without leaning too hard on discounts?

Discounts can fill units fast, but they are not a long-term strategy. The stronger play is consistent local visibility, better follow-up with leads, smarter promotions tied to real demand, and closer tracking of what is driving move-ins month to month.

How does self-storage software help operators run smarter in 2026?

Storage Commander’s SC Navigator takes pressure off your team while giving you clearer visibility into what is happening across your facility. When you can track occupancy trends, delinquency, lead sources, and performance in real time, you can stay proactive, move faster, and deliver a reliable customer experience without adding more staff.